As Flossmoor District 161 prepares to approve its 2016-17 budget, significant financial boosts are likely from both state and local sources.

With the retirement of Flossmoor’s tax increment financing (TIF) district last December, the Flossmoor school system is expecting a 2.8 percent increase in local tax revenues in the new fiscal year. Frances LaBella, District 161’s associate superintendent for business, said the TIF retirement will bring about $300,000 in additional revenues.

The TIF, during its 23-year lifespan, was used to finance infrastructure improvements in the area where Flossmoor’s Meijer superstore is now located. During the TIF period, property taxes in that area were frozen at their original rate.

On the state level, LaBella said Gov. Bruce Rauner has promised that schools will receive 100 percent of their general state aid (GSA) allotment. In recent years, schools have received a percentage of the so-called GSA foundation level, a figure set by the state to determine the fair share that all school districts should receive. In the 2015-16 budget year, District 161 received 92 percent of its GSA allotment.

If District 161 gets 100 percent of the foundation level, its GSA will jump more than 16 percent from the previous budget year, LaBella said. That would mean a state aid increase in excess of $624,000.

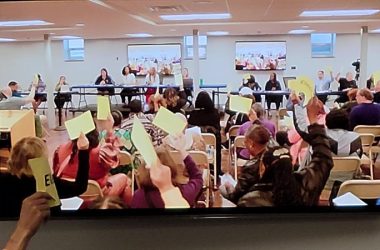

District 161’s school board is expected to vote on the proposed budget at its Sept. 12 meeting, which will begin at 7 p.m. at the Normandy Villa administration center, 41 E. Elmwood Drive in Chicago Heights.

The tentative budget shows anticipated revenues at $33,019,853 and expenditures at $32,850,329, resulting in an expected surplus of $169,524.

Revenues come from local, state and federal sources. The largest amount of revenue – more than $23.9 million – is generated on the local level, mostly from property taxes. The budget shows $7.47 million coming from state sources and $1.6 million coming from the federal government.

By far, salaries make up the largest portion of district expenses. District salaries total more than $17.8 million, with instructional costs accounting for more than $15.9 of the total amount.

District 161 pays expenses out of nine funds. The largest is the education fund, which is set at nearly $22.5 million in the new budget. The state’s tax cap law limits the amount that districts can levy for individual funds.

As a result, District 161 – and many other Illinois school systems – levy a higher-than-needed amount for the transportation fund so that money can be transferred later in the year to the education fund, if needed. That will be done again this year in District 161, where the transportation fund has been set at $5.1 million.

During her budget presentation at the Aug. 29 board of education committee meeting, LaBella said district officials and community members need to be aware of proposals being discussed in the Illinois General Assembly.

Legislators are discussing a shift in school pension costs from the state to the local level. If such a plan is approved, it will likely cost District 161 an additional $1.1 million a year, LaBella said.

Lawmakers are also considering a change in the state’s GSA funding formula, she said.

There is also a possibility that the General Assembly will approve a property tax freeze, a move that Rauner supports.

Any or all of those developments could have a substantial effect on future school budgets, LaBella said.