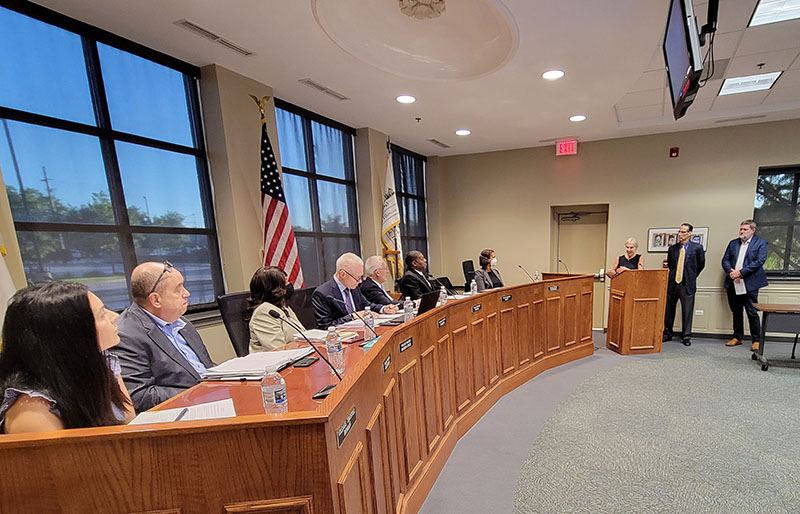

A delegation supporting the Homewood School District 153 tax increase referendum appeared before the Homewood Board of Trustees on Tuesday, Aug. 9, to ask for the board’s support for the issue on the Nov. 8 ballot.

After the group’s presentation, Mayor Rich Hofeld said the board would consider the request.

District 153 Board of Education President Shelly Marks, Superintendent Scott McAlister and Mike Dickover, representing Citizens for Homewood Schools, made the case for the referendum, which will give voters an opportunity to approve a hike to the district’s foundational tax rate for the first time in 30 years.

Voters approved short-term tax increases to back bond purchases in 2011 and 2016, but those were stopgap measures, Marks said. The rate hike will be a long-term improvement to the district’s financial health.

McAlister noted that the district is in the lowest tier in the state’s ranking of whether districts have adequate resources to educate students, about 35% below its target level. That leaves the district with a choice.

“You either bring in additional revenue, or you reduce spending,” he said. “And we feel that the supports we provide to our students and our families are so critical that reducing spending is not something we want to do unless we are forced to do it.”

He said the additional revenue would be spent in three main areas: eliminating the district’s funding deficit, building up cash reserves to the recommended level and addressing capital needs. He noted that the district’s buildings were built in the 1950s and 1960s and most have not had major renovations in two decades or more.

Dickover said he moved to Homewood 10 years ago because of the community’s diversity and the good reputation of the schools. He said the fact that the tax rate had not been raised in three decades “tells me that our schools are doing a great job at managing their budgets.”

“Without this referendum, the quality of education in our district could go down,” he said.

Trustee Jay Heiferman asked what impact the rate hike would have own property owners’ tax bills.

Marks said taxes for a home valued by the county assessor at $150,000 would go up about $460 per year or $38 per month. She said the increase would be eased in three years when the district pays off a bond. At that point, the tax impact would be reduced to $308 per year or $26 per month.